There’s no way you haven’t noticed how fast gas prices have risen in August. From $3.55 to $3.75, and now $3.87, the cost of a gallon of gasoline jumped by more than 30 cents in less than 30 days! U.S. motorists will have to cope with even higher prices in September, according to official estimates. By the end of the week, the average cost of regular gasoline could surge by another 10 cents and hit the $4 mark on Labor Day. From that point on, prices are expected to continue to climb due to a huge policy mistake made by the U.S. government. Analysts say that despite of the recent rise in domestic oil production, refiners still won’t be able to refill inventories and put a lid on fuel prices this year. Continued Below the vid

This will not only cause some serious sticker shock at the pump, but also hit your spending power right ahead of the holiday season, and force companies to keep raising their prices to offset higher transportation costs. The fuel crisis is going to affect every aspect of the economy and cause real hardship for American families. Data shared by Yahoo Finance’s Ines Ferre shows that this fall gasoline and diesel prices are expected to rise by $0.50 to $1.00, respectively, due to a policy mistake that is leaving America with a serious supply gap. Economists from the S&P Global Market Intelligence explained that there’s about a 70% correlation between gas prices and the way that consumers think of the U.S. economy.

And when you take into consideration that the cost of a gallon of gasoline is at the highest level in a year, of course, there are going to be higher implications down the supply chain. Higher fuel costs do not just impact consumers but are likely to keep driving inflation higher instead of lower as the Federal Reserve expects. For retailers, further pressure on transportation costs often results in price hikes on their products. Even though U.S. oil production is one of the highest in the world and it is on track to set a new record this year, our domestic inventories aren’t rising significantly.

The largest share of refined oil products is immediately sent by the market to meet demand, which is making it harder and harder to fill in the supply gap created in 2022. After the conflict between Russia and Ukraine began in February 2022, the Biden administration released large volumes of crude from the nation’s Strategic Petroleum Reserve to tame oil prices. In March of that year, officials announced the largest-ever sale from the reserve of 180 million barrels. The use of the SPR as an oil market management tool infuriated some OPEC+ producers. In other others, the latest increase in domestic production of 100,000 barrels per day isn’t going to make a true difference in the cost of fuels.

No wonder why the administration is on “alert” mode, said Robert McNally, the president of consultancy Rapidan Energy “The White House only has two kinds of modes when it comes to oil prices: oblivious or panicked.” The White House is finally realizing that it has committed a huge mistake, and our dependence on the global market means that the government can no longer control the situation at home. For that reason, we should all prepare for some major volatility on the gasoline market in September and beyond. It looks like a reckoning day has just arrived, and our system is going to face some drastic shifts as we move closer to 2024.

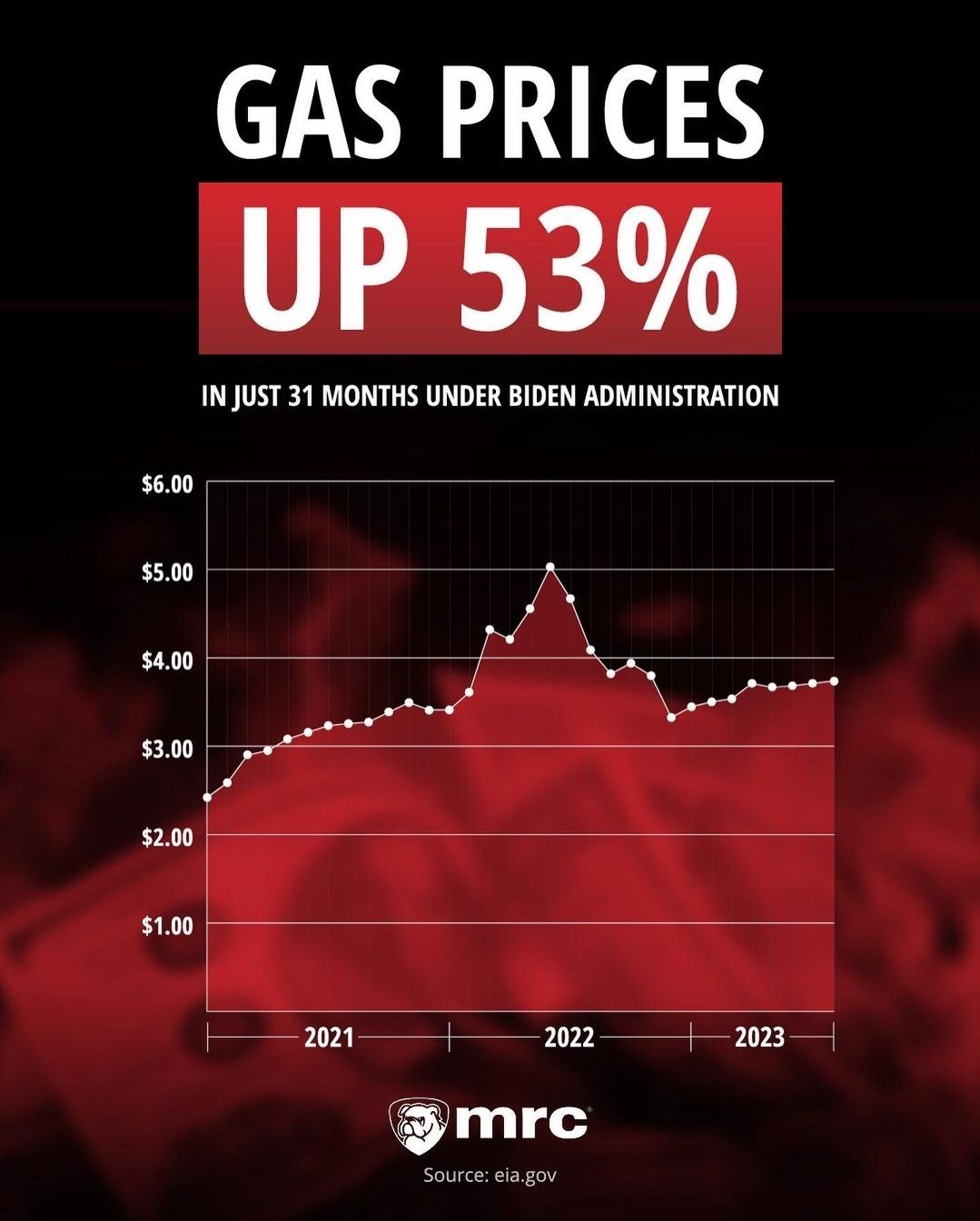

BIDENOMICS:

Gas prices are 68 cents per gallon higher than two years ago and $1.43/gallon higher than when Biden took office.

The average 30-year fixed-rate mortgage is at its highest in 22 years.

Most Americans say their personal financial situation is only fair or poor. pic.twitter.com/CANq4pjHJK

— RNC Research (@RNCResearch) August 27, 2023