Even the Democrats Detest Using Bidenomics As A Term Due to the Complete Failure of this President’s Policies

In the complex world of national economics and politics, the $34 trillion U.S. debt is often overlooked or not adequately explained by politicians and economists. However, understanding the basic math behind this staggering debt can provide valuable insights into potential future outcomes. Particularly concerning is the prospect of a perpetuity tax on Social Security, looming large with another four years of Bidenomics. Let’s delve into the fundamental numbers to decipher the potential consequences for individuals and corporations.

Seeing elected officials & candidates bemoaning the total federal debt hitting $34 trillion. Unless they support reforming Social Security or Medicare, or raising middle class taxes, you should dismiss their concerns as empty virtue signalling. All other reforms are too small- Brian Riedl

To comprehend the fiscal landscape, it’s helpful to view the government as a business, albeit a poorly managed one. In broad strokes, the government generates income through three main channels: Personal Income Tax (47% of U.S. revenue), Payroll Tax (Social Security and Medicare) (37% of U.S. revenue), and Corporate Income Tax (9.5% of U.S. revenue). Continued below this fast clip…

The lying ass Biden administration settled on a 3.2% raise for our seniors on social security, but illegals get everything for free! The government’s math is wrong, which is not surprising because we even have the wrong president! pic.twitter.com/OV4f8fFoM2

— JEDI 2 (@kung_fu_jedi) December 18, 2023

The lying Biden administration settled on a 3.2% raise for our seniors on social security, but illegals get everything for free! The government’s math is wrong, which is not surprising because we even have the wrong president!

On the expenditure side, the U.S. runs an annual fiscal deficit of approximately $1.8 trillion, with the top four expenses being Medicare/Medicaid (24% of spending), Social Security (22% of spending), Defense (13% of spending), and Net Interest on the Debt (11% of spending).

More of this please! While we are at it, what about having everyone pay social security on ALL their earnings, not just on the first $168,400.

Tax. The. Rich.https://t.co/LRSONzozDz— BeckieSwimsTheTide🌊🇺🇸🌊 (@Swimthetide1) January 4, 2024

Addressing the colossal debt conundrum requires a clear understanding that solutions involve a combination of decreasing expenses, increasing revenue, or both. Currently, the Social Security Board of Trustees estimates that, based on current law, the Social Security Trust Funds will be depleted by 2041.

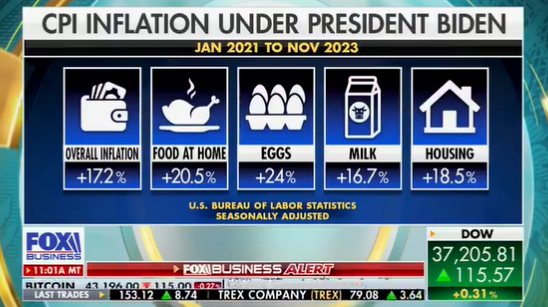

Biden Gives Bureaucrats Biggest Pay Bump Since Carter. A pay raise of 5.2%. Meanwhile, Social Security recipients only got just over 3% on their checks. So, is the cost-of-living cheaper for those of us on SS? The answer is no, it is not! Maga Patriot – links to Daily Signal article

For those unfamiliar with how Social Security tax operates, employees contribute 6.2% of every paycheck into Social Security until they reach the FICA wage base cap, set at $168,600 in 2024. Employers match this contribution, resulting in a combined 12.4% contribution from both parties. Self-employed individuals shoulder the full 12.4%, though they enjoy a small tax deduction during filing. Continued below the vid clip

The Joe Biden Administration Has Proposed $4.5 TRILLION In New Taxes But Plans On Letting Social Security Run Out

“In the $4.5 trillion of taxes the president has proposed —not a dime, is going to shore up Social Security.”

pic.twitter.com/s4V9KcJMho— Mississippi Sambo (@MS_Sambo_) January 1, 2024

The Joe Biden Administration Has Proposed $4.5 TRILLION In New Taxes But Plans On Letting Social Security Run Out “In the $4.5 trillion of taxes the president has proposed —not a dime, is going to shore up Social Security.”

President Biden’s 2023 declaration expressing a desire to turn payroll taxes into a “perpetuity” tax for income beyond $400,000 raises concerns. This proposal entails an additional 6.2% tax on every dollar earned above this threshold, both for the individual and their employer. Essentially, it’s a subtle method of increasing corporate and personal taxes simultaneously. With the “donut hole” between $168,600 and $400,000 narrowing, it’s not far-fetched to speculate that Social Security could become a perpetuity tax under Bidenomics in its second term.

Oh brother…I just googled your question…social security cost of living is only going up 3.2% compared to the 5.2% raise in government employees……I think Washington (Biden/Dems/Repubs) have some “explaining to do” … Greta Van Susteren

With nearly half of American families paying no federal tax, the prevailing solution in Bidenomics appears to be taxing the wealthy more. As 50% of the population contributes nothing in federal taxes, the burden inevitably falls on those earning higher incomes. Although increasing corporate taxes could make a dent, it pales in comparison to the revenue generated by payroll taxes.

So government workers get a big raise and social security recipients got 4.3% or so. Except Social Security is a return of a worker's wages – their own money. And then they have to pay income tax on it.

For whose benefit, illegals, government workers, Ukraine?

Insanity. https://t.co/Ker4oAqdEA— K (@mrsrdc1) January 2, 2024

As we face the ticking clock of the $34 trillion debt, it becomes evident that a perpetuity tax on Social Security is a plausible outcome over the next four years. The impact will extend to both individuals and employers, emphasizing the urgency for a comprehensive and sustainable fiscal strategy. Time is ticking, and the specter of losing 6.2% of every dollar earned looms large for many Americans. The Democrats are doing all they can to destroy the U.S. dollar and economy. Social Security is just one more casualty of the Marxist programs being implemented against the will of the American people.

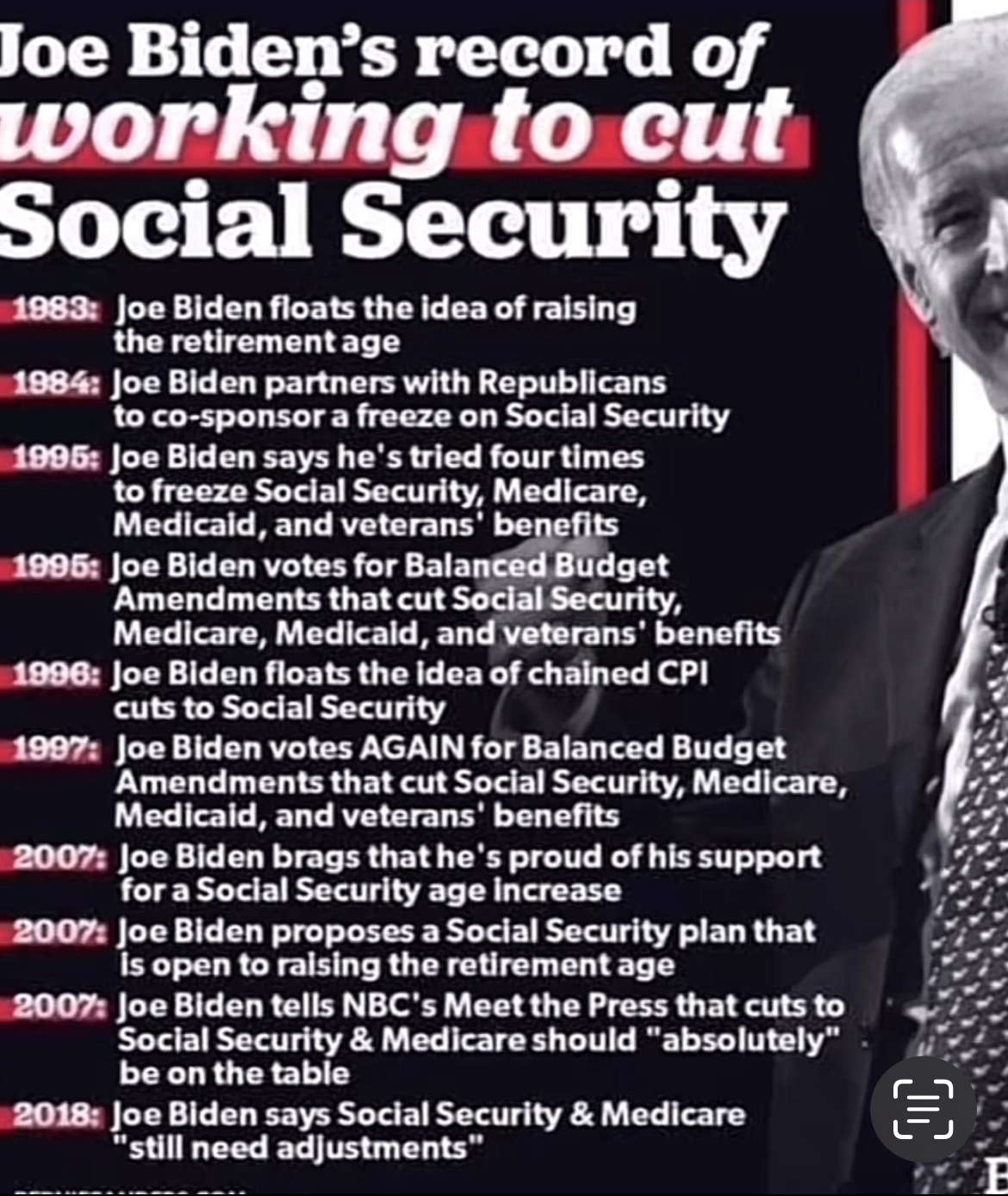

Joe Biden spent decades trying to cut Social Security. Democrats don’t like to talk about that!

Major Points Discussed:

- Joe Biden spent decades trying to cut Social Security. Democrats don’t like to talk about that!

- This is a straightforward explanations from politicians and economists regarding the intricate $34 trillion U.S. debt.

- It categorizes the government’s income into three primary sources: Personal Income Tax (47%), Payroll Tax (Social Security and Medicare) (37%), and Corporate Income Tax (9.5%).

- The U.S. incurs an annual fiscal deficit of $1.8 trillion, with the highest expenditures being Medicare/Medicaid (24%), Social Security (22%), Defense (13%), and Net Interest on the Debt (11%).

- By 2041, the Social Security Board of Trustees predicts depletion based on current law, necessitating a closer look at potential solutions.

- President Biden’s proposal to turn payroll taxes into a “perpetuity” tax for incomes above $400,000 raises concerns, potentially impacting both individuals and employers, as part of addressing the growing national debt.

Charles William, freelance writer

Comments – Threads – Links

- At 3% every 4 months, the US national debt will be $100 trillion in less than 13 years – about the same time the social security trust fund is projected to run out. We can’t afford four more years of Trump or Biden – Libertarian Party of Texas

- How have billionaires convinced the average Joe that tax cuts for billionaires and eliminating Social Security and Medicare, that we have paid into our whole working lives, are great ideas?- A Snarky Grandpa (Bruce)

- When I had my corporate job, that was the first time I noticed that. I couldn’t understand why they wouldn’t take it. I could afford it- Theresa M. Lewis

- It is far less financially painful for high income people to invest in social security than low income earners. It’s absolutely corporate welfare- BeckieSwimsTheTide

- Social security doesn’t work. Maybe we should be able to make our own decisions on retirement and opt out. Why should I be mandated into a program for the peanuts return in retirement- Moolium

- I don’t need SS to pay me one dime of billionaire money. That’s their ‘fair share’. I need SS to pay me back MY money like they promised- Spidey

- The Biden administration is causing Social Security to be on life support. American seniors who’ve paid into SSI could see a loss this year. many still underwater with inflation and making ends meet. Meanwhile, migrants often draw more from the US government than our seniors. – Octo Beech

Biden and crew are doing everything possible to take the nation down. Nations and banks around the world are buying Gold fast and at record amounts. Do yourself or your family a favor, check out GOLD now – Whatfinger endorses Goldco, which has helped people all over America to protect their 401Ks and retirement – get the free details – CLICK HERE or below…

News Junkies Delight…. One visit and you are hooked…. Come over to Whatfinger’s main page. All news and more news than any other site on the net.

– Whatfinger Sponsor

– Whatfinger Sponsor