Thanks to the Federal Reserve and Democrat Policies, Helped by RINOS, The Economy Is Dying From Debt. It’s a Bomb That We Cannot Stop From Exploding

We are now in a debt spiral. The interest on the national debt is over $1 trillion per year. The national debt is growing at the rate $3.5 trillion per year, roughly $1 trillion every 100 days. We just crossed $34 trillion. How does this end? Either cut spending (Congress can’t do that), or increase taxes (also very difficult). The 3rd option, which is most likely, is they do more of the same with massive inflation via the Fed monetizing the debt. Printer will go Brrr … the Fed will print trillions of $$$ digitally and buy most of the debt issued by the US govt, in order to try to control interest rates (yield curve control). – Wall Street Silver (commenting on fast 3 min clip below)

A few days ago Americans woke up to a late Christmas gift from Congress: $34 trillion in debt.

The milestone comes just 105 days since it broke $33 trillion.

Of course, $34 trillion doesn’t begin to cover what Congress promised and will never deliver. Between social security,… pic.twitter.com/BXlAWYnr8B

— Peter St Onge, Ph.D. (@profstonge) January 8, 2024

Episode 38 of the Podcast is up! – 25% of Retirement Assets are Gone – Rise of the “Welfare Industrial Complex” – Americans need another $11,400 to Survive – Here comes the Taxes – What are voters thinking? – Peter St Onge

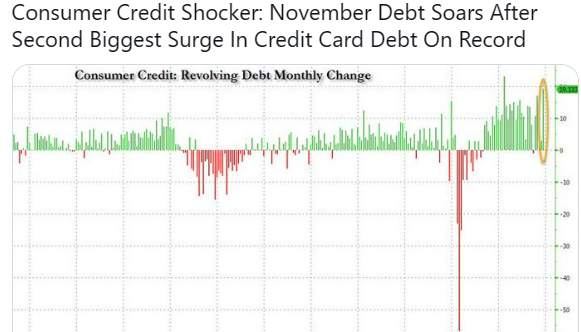

Consumer Credit Shocker: November Debt Soars After Second Biggest Surge In Credit Card Debt On Record https://t.co/r9Dz74tC8y

— zerohedge (@zerohedge) January 8, 2024

Credit card debt is the silent killer in America. You have to be out of your mind to pay 23% interest. You can’t win! So, NEVER spend more than you earn, and pay off your balance every single month. – Mr. Wonderful – fast 1 min clip see below

Credit card debt is the silent killer in America. You have to be out of your mind to pay 23% interest. You can’t win! So, NEVER spend more than you earn, and pay off your balance every single month. pic.twitter.com/vs7GMq0sB0

— Kevin O’Leary aka Mr. Wonderful (@kevinolearytv) January 3, 2024

In a recent report by Bankrate, a troubling trend has emerged, indicating that an increasing number of Americans are accumulating credit card debt to cover their daily essentials. This unsettling pattern may serve as a warning sign of potential economic challenges on the horizon.

Credit card debt continues to control Americans’ finances. 49% of cardholders are carrying a balance from month to month, the most common cause of this is due to emergency or unexpected expenses (43%). Read more on our latest survey – Bankrate

According to Bankrate’s findings published on Monday, nearly half of credit card holders, approximately 49%, are now carrying credit card debt from month to month. This represents a notable surge from just two years ago when only about 39% of Americans with credit cards had ongoing debt. Continued below this fast clip

This 29 year old woman goes on a rant after she couldn’t handle it anymore. She says that she’s drowning financially even though she has three jobs. It’s such a struggle that she has to constantly get into credit card debt because she doesn’t have enough after the first of the month to avoid it. It looks like millennials and gen Z are having a rough time. How are you fairing compared to her, also what are your thoughts?

This 29 year old woman goes on a rant after she couldn’t handle it anymore.

She says that she’s drowning financially even though she has three jobs.

It’s such a struggle that she has to constantly get into credit card debt because she doesn’t have enough after the first of… pic.twitter.com/TsQl0X1nK5

— Not Jerome Powell (@alifarhat79) January 3, 2024

Furthermore, the report highlights that over half of Americans burdened with credit card debt have been carrying it for more than a year. Even more distressing is the revelation that 10% of those holding credit card debt believe they may never be able to settle their bills. Another 25% expect to pay off their debt at some point but anticipate it will take at least five years. This is accelerating now, and the American population is, as a whole, becoming poorer thanks to Biden and the policies of the Democrat Party.

Financial Pros Offer Strategies as Americans Drown In $1 Trillion Credit Card Debt #PFshare via @wealthofgeeks https://t.co/V8uKOutTDP

— IRA Owner's Manual (@IRAOwnersManual) January 8, 2024

Ted Rossman, Bankrate’s senior industry analyst, remarked on the situation, stating, “While Americans are managing their credit card debt pretty well, all things considered, we are seeing pockets of trouble at the household level. If you have credit card debt, this is probably your highest-cost debt by a wide margin.”

We’re paying more and more to get less and less. Prices are rising, debt is rising, and financial anxiety is rising every day for working families. We’ve got to change course. – Coach Tommy Tuberville

The primary driver for Americans resorting to their credit cards is emergencies or unexpected expenses, such as medical bills, car repairs, and home maintenance. Everyday expenses are also cited as contributing to the rise in credit card debt.

61% of Americans are living paycheck to paycheck. Business and personal BKs are up 18%. Credit card debt is at an all time high. Bank deposits are at a 70 year low.

And the demented fascist responsible for this crap wants to be reelected. pic.twitter.com/20W2M4vapU— Mark Delbridge 🇺🇲🏴☠️ (@DelbridgeMark1) January 6, 2024

Consumer credit +23.751BN, Exp. 9.0BN, Last 5.134BN Credit card debt +19.133BN, second highest on record – ZeroHedge says. This revelation comes in the wake of a report from the New York Federal Reserve, indicating that total credit card debt surged to $1.08 trillion in the three-month period from July to September. This represents an increase of $48 billion, or 4.6%, from the previous quarter, marking the highest level on record in Fed data dating back to 2003 and the eighth consecutive annual increase.

Compounding the concern is the fact that interest rates are currently at exceptionally high levels. According to a Bankrate database dating back to 1985, the average credit card annual percentage rate (APR) reached a new record of 20.72% last week. This surpasses the previous record of 19% in July 1991.

Americans accumulating record credit card debt! Over $1T, 4.6% ↑. Delinquency rate: 0.7%. Cash-out refinances on the rise. Share your thoughts! 💳💬💰 #Debt #FinancialHealth pic.twitter.com/vawgvF6OqT

— Daniel Ripper (@deeripper) January 4, 2024

Dr. Roger Marshall, citing this CNBC article says: ‘Americans have racked up over $1 TRILLION in credit card debt as the Visa-Mastercard duopoly continues to increase swipe fees.’ The implications of this rise in credit card usage and debt become more pronounced when considering the extended period it takes to pay off debt at such high APR levels. For instance, with the average American owing $5,000 in debt, current APR levels would result in approximately 279 months and $8,124 in interest to pay off the debt, making only minimum payments.

This surge in credit card balances coincides with the Federal Reserve’s aggressive interest rate hike campaign aimed at combating stubborn inflation and cooling the economy. Although inflation has shown signs of slowing in recent months, it still stands at 3.7% compared to the same period the previous year, according to the most recent Labor Department data.

As thousands of Americans are working 2-3 jobs just to make ends meet and load up credit card debt to $2 trillion. “Our betters” received $500,000 in 👇🏻👇🏻👇🏻.

Notice these same people that promote “climate change” as critical were given private jet travel. pic.twitter.com/kQEIdqepvp— Existential Grandma #God #Family #Country (@UltraMaga46) January 8, 2024

The impact of this inflationary spike has created significant financial pressures for many U.S. households, leading to increased costs for everyday necessities like food and rent. The burden is disproportionately affecting low-income Americans, whose already stretched paychecks are acutely impacted by fluctuations in prices. As the nation grapples with these economic challenges, a closer examination of household finances and debt management becomes imperative to ensure long-term financial stability for all. Putting all of the financial speak aside, we have to all come to that moment where we must understand that the powers that be in Washington DC are doing all they can to destroy the finances of this nation. Every chance they get to waste taxpayer money, that we don’t have, they take. The Republicans are just as guilty as they go along with the Democrat plans to destroy this nation.

- Be prepared for anything, including lockdowns with your own Emergency Med kit – see Wellness Emergency Kit (includes Ivermectin and other essential drugs – get approved over the phone – Dr. McCullough’s company!) 🛑

- Get the Spike Control formula to help you clean your blood out of spike proteins from the vaccine. Proven to clean blood and save lives. 👍 – Whatfinger Sponsor

Major Points Discussed:

- Almost half of American credit card holders (49%) are now carrying debt from month to month, a significant increase from just two years ago (39%).

- More than half of those with credit card debt have been carrying it for over a year, with 10% believing they may never be able to pay off their bills.

- Emergency expenses, such as medical bills and unexpected costs, are the primary reasons Americans turn to their credit cards, along with day-to-day expenses.

- The total credit card debt in the U.S. surged to $1.08 trillion in the three-month period from July to September, marking the highest level on record.

- The average credit card annual percentage rate (APR) hit a new record of 20.72%, creating concerns about the extended time and high interest costs required to pay off existing debt.

⚠️November Credit Card debt exploded by a whopping $19.1 BILLION totaling $1.02 TRILLION!

•a record surge from the $2.9BN in October

•2 biggest monthly increase in credit card debt on record! pic.twitter.com/HPByjz3FBl

— The Coastal Journal (@1CoastalJournal) January 8, 2024

Charles William

Comments – Threads – Links

- EVEN ASKED THEM IF WE CAN BORROW TRILLIONS OF DOLLARS ON THEIR GENERATIONAL-CREDIT-CARD THAT THEY WILL HAVE TO PAY BACK. AND NO, AMERICA CANNOT DECLARE BANKRUPTCY TO GET RID OF THE NOW $34 TRILLION NATIONAL DEBT $34,000,000,000,000. AT LEAST WE CAN ASK YOUNG-AMERICANS BY GIVING – manmohan chawla

- Last reports show: *we lost more full time jobs, *added more part time jobs, *a record number of Americans now are working 2 jobs, *credit card delinquencies are rising, *household consumer debt is soaring. Your economic golden city is a mirage. – Michael White For US Congres

- “Outstanding education debt in the U.S. exceeds $1.7 trillion, burdening Americans more than credit card or auto debt. The average loan balance at graduation has tripled since the ’90s, (to $30,000 from $10,000). Around 7% of student loan borrowers are now more than $100,000 in debt.” (CNBC) – Tevis

- America’s Credit Card Debt Crisis – Over the past two years, Americans’ credit card balances have skyrocketed 40 percent, according to the New York Fed. – John Barb

- The right direction? Prices are out of control, credit card debt is soaring, and the housing market is tanking. Biden’s economy is a nightmare for Americans. – Morgan Luttrell

- 56 million Americans have been in credit card debt for at least a year. ‘We are seeing pockets of trouble,’ expert says – CNBC

Biden and crew are doing everything possible to take the nation down. Nations and banks around the world are buying Gold fast and at record amounts. Do yourself or your family a favor, check out GOLD now – Whatfinger endorses Goldco, which has helped people all over America to protect their 401Ks and retirement – get the free details – CLICK HERE or below… News Junkies Delight…. One visit and you are hooked…. Come over to Whatfinger’s main page. All news and more news than any other site on the net.

News Junkies Delight…. One visit and you are hooked…. Come over to Whatfinger’s main page. All news and more news than any other site on the net.