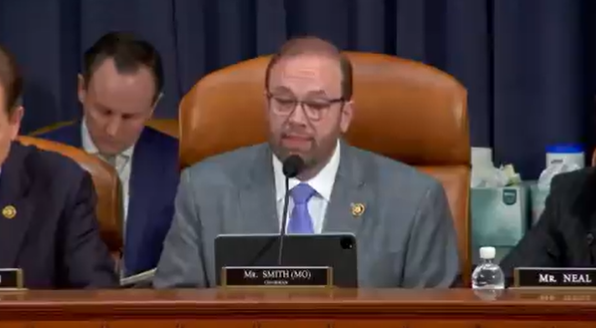

During the last Ways and Means Committee hearing, IRS Commissioner Werfel committed to adjusting and processing Child Tax Credit refunds under the Tax Relief for American Families and Workers Act in as few as 6 weeks so working families struggling in the Biden economy can get immediate relief and refunds are not needlessly delayed. see clip below

During today’s Ways and Means Committee hearing, IRS Commissioner Werfel committed to adjusting and processing Child Tax Credit refunds under the Tax Relief for American Families and Workers Act in as few as 6 weeks so working families struggling in the Biden economy can get… pic.twitter.com/HqkkrClBMf

— Rep. Jason Smith (@RepJasonSmith) February 15, 2024

The IRS would be able to implement changes to the Child Tax Credit within weeks, IRS Commissioner Danny Werfel told Congress, and send out tax refunds promptly.

The prospect of swift child tax credit refunds looms on the horizon with the potential enactment of a bipartisan tax package, according to IRS Commissioner Danny Werfel. Addressing lawmakers on Capitol Hill during a hearing on February 15, Werfel emphasized the urgency of implementing the Tax Relief for American Families and Workers Act of 2024, which garnered overwhelming support in the House with a 357-70 vote in January.

Those tax credits aren’t going to help with costs that will affect families from the invasion of +7milllion illegals that the Biden Admin is facilitating. These people will increase housing costs; schools getting worse; wages getting worse + higher inflation due to the IRA Act- Scott Wahl

Under the $79 billion tax cut package, Werfel assured the Ways and Means Committee that he would diligently work to ensure the issuance of refunds within a timeframe of six to 12 weeks. The legislation directs the IRS to process refunds “as expeditiously as possible,” with a commitment to being closer to the six-week mark than the 12-week mark, pending the final language.

The proposed legislation, spearheaded by House Ways and Means Chairman Jason Smith (R-Mo.) and Senate Finance Committee Chair Ron Wyden (D-Ore.), seeks to incrementally enhance the refundable portion of the child tax credit. The plan outlines an increase from $1,800 to $1,900 and subsequently to $2,000 for each tax year spanning from 2023 to 2025.

Currently set at $2,000 per child, the tax credit is not entirely refundable. The legislation introduces several key provisions, including an inflation adjustment for the child tax credit in 2024-2025. Notably, for tax years 2024 and 2025, taxpayers can use their earned income from the prior taxable year to calculate their maximum child tax credit, providing flexibility amid income fluctuations.

The legislation maintains a threshold requiring households to have $2,500 in income to be eligible for refundable child tax credit payments. According to estimates from the nonpartisan Tax Policy Center, households benefiting directly from these changes can anticipate an average tax cut of $680 in the initial year.

House Democrats fought for a significant increase in the state's Child and Dependent Care Tax Credit. This extra money will take some of the burden off hard working Pennsylvania families. pic.twitter.com/HjRHL5eDVC

— Rep. Morgan Cephas (@RepCephas) February 15, 2024

In addition to the child tax credit adjustments, the bill incorporates Trump-era tax breaks for businesses, a longstanding priority for Republicans. These provisions encompass extending multiple elements from the 2017 Tax Cuts and Jobs Act, including the reinstatement of full expensing for domestic research and development costs and the temporary offering of 100 percent bonus depreciation for equipment and short-lived capital asset purchases. The bill also extends the time frame for certain business deductions.

Despite its success in the GOP-controlled House, the legislation faces opposition in the Senate. Some senators express concerns, particularly regarding the provision allowing taxpayers to use the prior year’s earned income to calculate their maximum child tax credit, fearing potential disincentives for Americans to work.

Somewhat fascinating to me that Mitt Romney cares more about keeping Trump out of the WH than Joe Manchin does. Of course, Joe Manchin killed the child tax credit because he thought parents might use the money on drugs so ya know. https://t.co/KgZ9FNEoBD

— Jason Karsh (@jkarsh) February 15, 2024

A recent paper by researchers at the American Enterprise Institute raised concerns about the “look back” provision, suggesting it could have significant impacts on the labor market, necessitating further study before consideration by Congress. However, Democrats, including Senator Wyden, contend that the measure will benefit 16 million children from low-income families.

During the hearing, Werfel assured lawmakers that the IRS is closely monitoring the legislation’s progress. Drawing on the agency’s experience with economic impact payments during the pandemic, Werfel indicated the potential for implementing measures as early as six to 12 weeks after passage, depending on the final language of the bill. He urged taxpayers not to wait for the legislation to file their returns, assuring that the IRS would take care of providing additional refunds to those who have already filed without requiring additional steps.

- Be prepared for anything, including lockdowns with your own Emergency Med kit – see Wellness Emergency Kit (includes Ivermectin and other essential drugs – get approved over the phone – Dr. McCullough’s company!) 🛑

- Get the Spike Control formula to help you clean your blood out of spike proteins from the vaccine. Proven to clean blood and save lives. 👍 – Whatfinger Sponsor

Major Points Discussed:

- Bipartisan tax package could expedite child tax credit refunds.

- IRS Commissioner Danny Werfel aims to issue refunds within 6 to 12 weeks if legislation is enacted.

- The Tax Relief for American Families and Workers Act of 2024 proposes incremental increases in the refundable portion of the child tax credit, reaching $2,000 by 2025.

- The legislation introduces provisions such as an inflation adjustment, flexibility in using prior-year earned income for calculating credits, and a $2,500 income threshold for eligibility.

- Despite support in the House, the bill faces Senate opposition, particularly regarding concerns about potential disincentives for Americans to work due to certain tax breaks.

Comments – Threads – Links

- Mitt Romney is an old school Republican and has some principles. Joe Manchin is more like a modern Republican with one principle – self interest. He’s officially a Democrat but has never acted like it- Good boi

- $33T with a social safety net that’s a time bomb. Less revenue is the answer? If so, how about lowering rates for everyone, especially those who pay alot- Shane

- Well, what choice does the IRS have if the tax code changes were not finalized before people starting filing their tax returns?- Andrea E

- Senator Reverend is unaware that GA Republicans are already preparing tax cuts for hard working Georgia families- Wiley Thruster

News Junkies Delight…. One visit and you are hooked…. Come over to Whatfinger’s main page. All news and more news than any other site on the net.

News Junkies Delight…. One visit and you are hooked…. Come over to Whatfinger’s main page. All news and more news than any other site on the net.