Americans largely consider their financial situations as stable, with a majority stating they are “doing at least OK financially,” despite ongoing concerns about inflation and some struggling to pay bills. This information comes from a comprehensive survey conducted by the Federal Reserve, which annually examines thousands of U.S. residents regarding their household finances, covering aspects like income, savings, and expenses. We all know how you can fake polls and studies, so media is throwing this out there as if it were a fact. Meanwhile back in reality, the American family situation is the worst it has been in decades. And even the media knows it. So no matter how many studies they come up with, they only create more and more Trump voters with each lie. Everyone who eats or shops for food knows Biden and the Democrats are con artists.

🤔High inflation made finances worse for 65% of Americans last year

This is not going to play well with the Dems in November. https://t.co/tbVn4h9mlq— DeplorableRocky 3 (@Capemayrocky) May 22, 2024

The latest Leftist survey, carried out in the fall, indicates that 72% of adults feel they are financially comfortable or at least managing adequately, a slight decline from 73% in 2022 and 78% in 2021. This downturn reflects a gradual stabilization post the financial boost many experienced from pandemic relief payments and the initial stages of inflation.

Significantly, families with children under 18 have experienced a sharper decline in financial well-being. Only 64% of such households reported feeling at least OK, a notable drop from 75% in 2021. For many of these families, child care remains a substantial burden, often costing nearly half as much as housing expenses. The median monthly expense for child care stands at $800, but this rises to $1,100 for those needing over 20 hours a week of care.

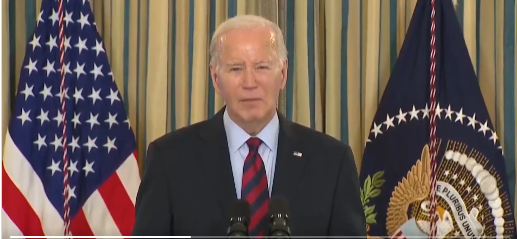

Joe Biden is campaigning on #Bidenomics.

But high inflation made finances worse for 65% of Americans in 2023.

How does he explain that?https://t.co/Snq1lMM4Si

— Club for Growth (@club4growth) May 21, 2024

Income and expense trends showed that about one-third of respondents reported an increase in monthly income, whereas 38% experienced rising monthly expenses. Despite a reduction in inflation rates compared to the previous years, two-thirds of Americans expressed that the escalating prices worsened their financial situation; 19% described their circumstances as significantly deteriorated.

Lower-income households particularly face severe financial difficulties, with many unable to pay monthly bills or afford basic necessities like food or medical care. Overall, 48% of those surveyed mentioned having surplus money after covering expenses, yet 17% had bills left unpaid from the previous month. When confronted with an unexpected expense of $400, 63% believed they could handle it using their savings—a figure consistent with 2022 but slightly lower than in 2021. Additionally, about one in eight people admitted they would be incapable of managing such an expense by any means.

BREAKING: Karine Jean-Pierre finally admits that Bidenomics is crashing people financially.

Glad that Alexander called out Biden’s ridiculous student loan debt relief. pic.twitter.com/TcFsbOXb6f

— I Meme Therefore I Am 🇺🇸 (@ImMeme0) May 22, 2024

The survey also introduced a new question this year regarding home insurance, noting that while most homeowners maintain insurance, significant rate increases have been observed, particularly affecting vulnerable populations. Notably, over 20% of low-income families in the Southern regions lack home insurance.

The Federal Reserve continues to use this annual survey to gain insights into how American families are navigating the economic challenges they face, aiming to understand and address the financial realities across various demographics. We all know how much the Federal Reserve has the best interests of the American people at heart, while they continue to destroy the economy, send our money to Ukraine, and destroy our dollar. Yeah….we believe them.

Bidenomics continues to destroy the U.S. economy.

Check out all the restaurants that’ve now closed because of Bidenomics.

Sad!pic.twitter.com/WA72Cx5ZIW

— Paul A. Szypula 🇺🇸 (@Bubblebathgirl) May 22, 2024

Major Points

- Approximately 72% of Americans report feeling financially comfortable or at least managing okay, a slight decrease from previous years.

- Financial stability has notably declined for families with children under 18, with only 64% feeling financially secure, compared to 75% in 2021.

- While a third of people saw their income increase, 38% experienced higher monthly expenses, with many citing rising prices as a deteriorating factor in their financial health.

- About 17% of respondents had unpaid bills, and nearly one in eight could not afford an unexpected $400 expense.

- The survey introduced questions about home insurance, revealing significant price hikes and a lack of coverage among over 20% of low-income families in the South.

James Kravitz – Reprinted with permission of Whatfinger News