Modi wins in India, and the stock market reacts to party losses that were not expected

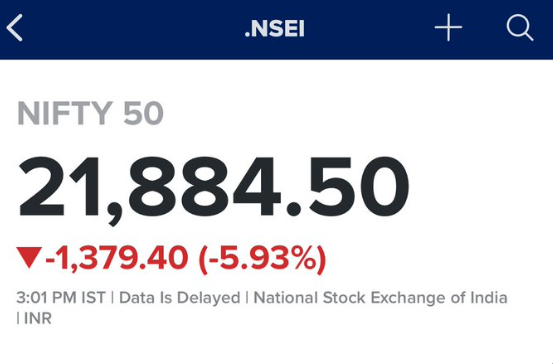

India’s stock markets tumbled on Tuesday amid volatile trading, leading Asian markets lower as the country continued to count votes for its 2024 general election. The Nifty 50 index fell about 5%, and the BSE Sensex dropped more than 5%, influenced by early projections suggesting a tighter-than-anticipated contest between the BJP-led NDA and the Congress-led I.N.D.I.A bloc.

Even if we get a Modi super majority, the government will need to focus on the economic agenda to keep the market rally going, Bloomberg’s Mary Nicola says.

Follow our free-to-read live blog: https://t.co/RLBEO6jtTo pic.twitter.com/1Fdxspz2da

— Bloomberg Asia (@BloombergAsia) June 4, 2024

By afternoon, both benchmarks were nearing the point of erasing this year’s gains. Last year, the Nifty had risen over 20%, and the Sensex nearly 19%. On Monday, both indexes had reached record highs following weekend exit polls indicating that Prime Minister Narendra Modi was poised to secure a rare third consecutive term with a significant majority.

Elsewhere in Asia, Japan’s Nikkei 225 fell 0.22% to close at 38,837.46, and the broader Topix declined 0.38% to end at 2,787.48. South Korea’s Kospi shed 0.76% to finish at 2,662.10, while the smaller-cap Kosdaq edged up 0.13% to 845.84. Hong Kong’s Hang Seng index increased by 0.12%, and the CSI 300 index rose by 0.75% to close at 3,615.67. In Australia, the S&P/ASX 200 index dropped 0.31% to 7,737.10.

In the United States, stock index futures were largely flat as Wall Street sought stability after a rocky start to June. Futures for the Dow Jones Industrial Average were approximately unchanged, while futures for the S&P 500 and Nasdaq 100 inched up less than 0.1% each. On the first trading day of June, the Dow fell over 115 points, or 0.3%, while the S&P 500 and Nasdaq Composite saw modest gains.

What are some of the biggest risks for the Indian markets as Modi seeks a historic third term? Radhika Gupta of Edelweiss Mutual Fund has the answer.

Follow our free-to-read live blog for more https://t.co/wVVjxvHn6g pic.twitter.com/V7yQAMGcjI

— Bloomberg Asia (@BloombergAsia) June 4, 2024

Adani Group companies experienced a significant decline, with shares plummeting nearly 20% as the vote count indicated a close contest between the BJP-led NDA and the Congress-led I.N.D.I.A bloc. Adani Ports dropped by more than 18%, and Adani Enterprises fell 19%. This contrasted sharply with Monday’s gains, where both stocks had risen over 5% following exit poll results predicting a decisive BJP victory.

India’s main stock indexes continued to fall in early trading as the country began counting votes for its 2024 general election. The Nifty 50 and BSE Sensex both declined nearly 3% after reaching record highs on Monday. Adani Ports and Adani Enterprises saw their shares fall more than 8% and 9%, respectively.

The vote counting started at 8 a.m. local time, with projections indicating that Prime Minister Narendra Modi might win a rare third term. Exit polls over the weekend had forecasted a significant majority for Modi and his BJP-led alliance in the lower house of parliament.

India stock market is down almost 6% to lead Asia markets lower on tighter-than-expected election race; Adani stocks drop 20%. pic.twitter.com/tz0UDAIwob

— Steve Burns (@SJosephBurns) June 4, 2024

In South Korea, consumer inflation slowed in May, marking the slowest pace in 10 months. The consumer price index increased by 2.7% year-on-year, below the expected 2.8% rise and April’s 2.9% gain. The core CPI, excluding volatile food and energy prices, rose by 2.2%.

On a different note, a U.S. company that provides electronic design software to chip makers has been overlooked by investors, according to a fund manager at Liontrust. The company offers tools to engineers to identify and rectify issues in chip designs before manufacturing, playing a crucial role in the growth of AI technology.

Additionally, experts suggest there are still affordable alternatives to Nvidia for those looking to invest in the AI boom. While Nvidia shares have been hitting record highs, other tech stocks have also benefited from positive sentiment around AI, pushing the Nasdaq to new heights.

Goldman Sachs vice chairman and former Dallas Fed President Robert Kaplan mentioned that a rate cut is unlikely before September unless significant improvements in inflation are observed. The central bank’s next policy decision is expected on June 12.

Lastly, GameStop shares rose 3% in after-hours trading, following a 21% increase during regular hours. The surge came after a Reddit post, seemingly from Keith Gill (known as “Roaring Kitty”), indicated he still holds his GameStop shares and call options.

Major Points:

- India’s Nifty 50 and BSE Sensex dropped over 5% amid volatile trading during the 2024 general election vote count.

- The declines followed record highs on Monday, influenced by exit polls suggesting a third consecutive term for Prime Minister Narendra Modi.

- Adani Group shares plunged nearly 20%, with Adani Ports and Adani Enterprises falling more than 18% and 19%, respectively.

- Asian markets experienced mixed results, with Japan’s Nikkei 225 and South Korea’s Kospi declining, while Hong Kong’s Hang Seng and China’s CSI 300 saw gains.

- U.S. stock index futures were flat, and Goldman Sachs’ Robert Kaplan indicated that a rate cut is unlikely before September without significant inflation improvement.

Al Santana – Reprinted with permission of Whatfinger News