A.I. and the creation and facilitation of it in all ways, looks to bring great value to the S&P 500 and Nasdaq. As companies become more efficient, value will be add, profits enlarged, and shareholders of course, will profit.

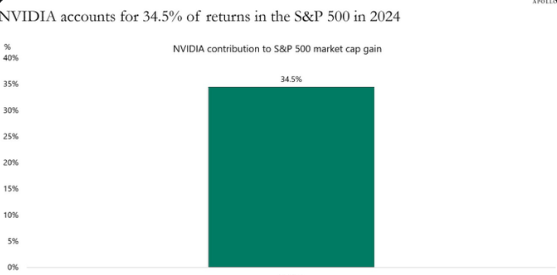

Nvidia’s stock has witnessed a remarkable rally this year, propelling the company’s valuation beyond the $3 trillion mark and significantly boosting its share in the S&P 500. Apollo’s Chief Economist, Torsten Sløk, has noted that a substantial 34.5% of the S&P 500’s market capital gains this year are solely attributable to Nvidia, reflecting its dominant role in the index.

Nvidia vs #Bitcoin vs Gold 🤑 pic.twitter.com/88fUdeBNJH

— Thomas | heyapollo.com (@thomas_fahrer) June 16, 2024

The company’s shares have surged by 166% year-to-date and are up more than 200% compared to the same period last year. This surge is largely driven by the booming demand for artificial intelligence, with Nvidia at the forefront as a leading supplier of AI chips. Quarterly earnings reports suggest that this demand shows no signs of abating, keeping investor enthusiasm high.

However, Sløk has expressed concerns about the risks associated with such a heavy reliance on a single stock within the S&P 500. He warned that while Nvidia’s continued growth could maintain stability, any decline could disproportionately impact the broader market index. This is particularly relevant given the market cap-weighted nature of the S&P 500, where significant movements in large companies like Nvidia, Apple, and Microsoft can substantially affect the index.

Furthermore, as more retail investors invest in S&P 500 index funds, their exposure to Nvidia’s performance increases, potentially heightening the impact of any single corporate event or market shift on their investments. Sløk pointed out that the current extreme concentration of returns in the index heightens vulnerability to fluctuations driven by developments in a few key stocks.

Nvidia stock accounts for more than a third of the S&P $SPY 500’s gains this year—and it’s a big risk for investors, top … – Fortune https://t.co/QGEunH4tIr

— Stock Market News (@Stock_Market_Pr) June 15, 2024

Historically, Sløk has consistently highlighted the risks of the stock market’s dependency on big tech companies, likening today’s tech valuations to the bubble experienced during the dot-com era. He previously raised concerns when Nvidia’s market cap first exceeded $2 trillion, noting that tech companies today appear more overvalued than the top companies during the 1990s tech bubble.

Despite these warnings, some analysts remain optimistic about Nvidia’s future growth. Beth Kindig, a lead tech analyst, predicts that Nvidia’s market cap could reach as high as $10 trillion by 2030, anticipating further significant gains. On the operational front, Nvidia’s CEO, Jensen Huang, has also been actively shaping the company’s future growth trajectory by announcing plans to continually upgrade its AI accelerators. This includes the introduction of the Blackwell Ultra chip set for release in 2025 and another next-generation platform, Rubin, planned for 2026.

NVIDIA currently accounts for 34.5% of the S&P 500’s market cap growth this year. Torsten Sløk @apolloglobal notes “If it starts to decline, then the S&P 500 will be hit hard.”https://t.co/ZQJI6imjD8 pic.twitter.com/PNcKPTO7UA

— Edward Conard (@EdwardConard) June 13, 2024

As Nvidia continues to innovate and lead in the AI chip market, its influence on the stock market and investor portfolios is likely to remain substantial, underscoring the intertwined nature of tech innovation and market dynamics. However, the warnings from economists like Sløk serve as a reminder of the potential volatility and risks inherent in such a concentrated market influence. If Elon Musk and others are correct, the next few years can still easily see explosive growth for Nvidia and other companies such as AMD, Dell and Tesla.

Major Points:

- Nvidia’s stock has soared, pushing the company’s valuation past $3 trillion and accounting for 34.5% of the S&P 500’s market cap gains this year.

- The stock has risen 166% year-to-date, fueled by strong demand for AI chips as Nvidia leads in this technology sector.

- Chief Economist Torsten Sløk expressed concerns about the risks of the S&P 500’s heavy reliance on a single stock, noting potential broad market impacts if Nvidia’s stock declines.

- Despite warnings of overvaluation similar to the dot-com era, some analysts remain optimistic, with predictions of Nvidia reaching a $10 trillion market cap by 2030.

- Nvidia plans continual innovation, including the release of the Blackwell Ultra chip in 2025 and the Rubin platform in 2026, signaling ongoing leadership in AI technology.

Charles William III – Reprinted with permission of Whatfinger News