New Installment features. Are they the way to go?

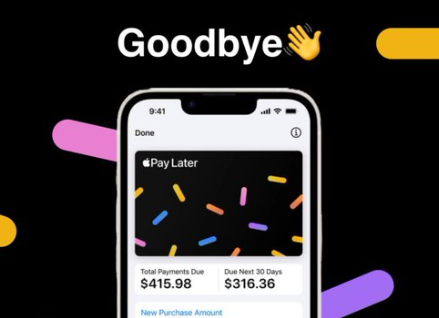

Apple has decided to shut down its “buy now, pay later” service, Apple Pay Later, less than a year after its launch. This decision takes effect in the U.S. as of Monday, just ahead of the rollout of new Apple Pay features expected to be available on iPhones this fall. These new features will allow Apple Pay users to make purchases and access installment loans through Affirm, a third-party lender.

Apple scraps its buy now, pay later service ahead of a new program in the fall. @MadisonMills22 shares the details: pic.twitter.com/MCLJeo24gv

— Yahoo Finance (@YahooFinance) June 18, 2024

In a statement to a technology news outlet, Apple explained the rationale behind this decision: “With the introduction of this new global installment loan offering, we will no longer offer Apple Pay Later in the U.S.” The company emphasized its commitment to providing users with easy, secure, and private payment options through Apple Pay. This new solution is expected to bring flexible payment options to more users globally, in collaboration with Apple Pay-enabled banks and lenders.

Despite the discontinuation, Apple reassured users with active Apple Pay Later loans that they could still manage their loans through the Apple Wallet app. Apple, however, did not immediately respond to further requests for comments on the discontinuation.

BREAKING: Apple cancels its Buy Now Pay Later option for Apple products. pic.twitter.com/bZq92IDSBl

— Financelot (@FinanceLancelot) June 18, 2024

The “buy now, pay later” (BNPL) model has gained significant traction among consumers, with more than 40% of Americans reportedly using such services, according to a Lending Tree survey. These loans are designed to encourage consumers to borrow and spend more, but they come with risks. Users may face fees if they miss payments, potentially leading to accumulated debt.

In recent years, the popularity of BNPL services has surged. In 2021, BNPL loans totaled $24 billion, a sharp increase from $2 billion in 2019, according to a report by the Consumer Financial Protection Bureau (CFPB). This payment option has become ubiquitous in both physical stores and online shopping platforms. However, the “pay later” aspect has posed challenges for many consumers who struggle with managing these deferred payments.

Apple is discontinuing its buy now, pay later service known as Apple Pay Later barely a year after its initial launch in the U.S., and will rely on companies who already dominate the industry like Affirm and Klarna.https://t.co/8gLieM16a6

— KOMO News (@komonews) June 18, 2024

Financial regulators have been scrutinizing the BNPL industry since 2021, leading to the implementation of new rules designed to protect consumers. In May, the CFPB issued a rule mandating that BNPL lenders offer the same protections that apply to conventional credit cards. These protections include the right for consumers to dispute charges and receive refunds from lenders after returning purchases made with BNPL loans.

Apple kills off its buy now, pay later service barely a year after launch https://t.co/z6mUvljpKr

— KGW News (@KGWNews) June 18, 2024

Apple’s decision to discontinue Apple Pay Later seems to align with the broader industry trend towards providing more secure and flexible payment options while adhering to regulatory requirements. The collaboration with Affirm and other Apple Pay-enabled banks and lenders aims to enhance the global reach and reliability of Apple’s payment services. As Apple continues to innovate and expand its financial offerings, the focus remains on ensuring consumer protection and providing robust, flexible payment solutions.

Key Points:

i. Service Discontinued: Apple has shut down its Apple Pay Later service in the U.S., less than a year after its launch.

ii. New Features: The discontinuation comes ahead of the introduction of new Apple Pay features, including installment loans through Affirm, set to launch this fall.

iii. Active Loans: Users with active Apple Pay Later loans can still manage them through the Apple Wallet app.

iv. Industry Context: The BNPL industry has seen significant growth, with $24 billion in loans in 2021, up from $2 billion in 2019, but it has also faced regulatory scrutiny and new consumer protection rules from the CFPB.

v. Apple’s Commitment: Apple emphasized its focus on providing secure, flexible payment options globally, collaborating with banks and lenders to enhance its Apple Pay service.

Al Santana – Reprinted with permission of Whatfinger News