The country faces a disaster thanks to the Biden economic policies. Banks though are ahead of the game and doing some selling, and fast.

Major banks in the United States, including Goldman Sachs and Citigroup, are starting to sell off their commercial real estate loans, particularly those tied to office buildings in major cities like New York, San Francisco, and Boston. This move comes as a response to growing concerns over potential defaults and the broader implications for the banking sector due to the increasing trend of working from home.

Bitcoin miners face capitulation post-halving, crypto deepfakes could lead to $25bn losses, Meta’s holographic glasses may revolutionize Web3, US banks offloading $2.5T in commercial real estate loans, AI being trained for creative chess moves. pic.twitter.com/9if4IS7F7W

— cryptosummary (@cryptosummaryhq) June 30, 2024

The sale includes significant transactions such as portions of a $1.7 billion loan and a $1 billion portfolio from Capital One that consisted largely of office loans in New York. These sales, while representing a small fraction of the total $2.5 trillion in commercial real estate loans held by U.S. banks, mark a significant shift in strategy away from the previous approach of “extend and pretend,” where banks would delay recognizing losses on loans.

This strategy change reflects a growing realization among financial institutions that the downturn in the commercial real estate sector, exacerbated by the shift to remote work, is likely to persist. The potential for a wave of defaults is prompting banks to preemptively mitigate losses by unloading riskier loan exposures.

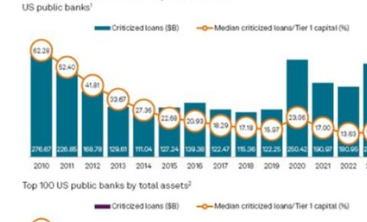

📉 US banks’ risky loans hit a 14-year peak. Are we heading for a financial slope? 💸 #Banking #RiskManagement pic.twitter.com/nMy8kzC4iJ

— Kaufman Real Estate & Consulting (@dkaufmanredev) June 26, 2024

Data from the real estate analytics firm ATTOM indicates a sharp rise in commercial real estate foreclosures, with a 117% increase nationally in March compared to the previous year. California has been particularly hard hit, experiencing a 405% surge in foreclosures, underscoring the severity of the market downturn.

More than half of commercial real estate loans reported in the US is held by banks with less than $50 billion in assets, analysis shows pic.twitter.com/GJswxJRJDf

— Ani Mardikian (@animardikian_) June 20, 2024

The implications of these developments are profound, not only for the banks involved but also for the commercial real estate market and the broader economy. As banks adjust their strategies in anticipation of continued challenges in the sector, the fallout could include tighter credit conditions and a reevaluation of property values, particularly in markets heavily dependent on office spaces.

Key Points:

i. Major US banks like Goldman Sachs and Citigroup are selling off commercial real estate loans due to fears of defaults, particularly in office buildings.

ii. These sales include significant portions of multi-billion dollar loans and reflect a shift from the previous banking strategy of delaying loan loss recognition.

iii. The trend towards remote work is exacerbating challenges in the commercial real estate sector, leading to increased loan foreclosures.

iv. Recent data shows a significant rise in commercial real estate foreclosures nationwide, with California experiencing the most severe increase.

v. This strategic shift by banks could lead to tighter credit conditions and necessitate a reevaluation of property values in the commercial real estate market.

TL Holcomb – Reprinted with permission of Whatfinger News