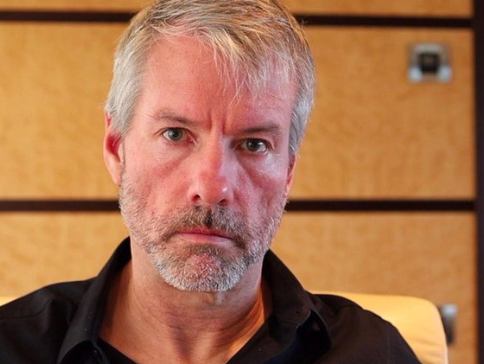

Because of his aggressive Bitcoin investment approach, MicroStrategy CEO Michael Saylor has seen significant income swings. Saylor’s larger investment strategy has been generally successful despite a recent setback as he lost $105 million on a purchase of 11,931 bitcoins on June 20, 2024. convertible debt, a technique that turns into stock and can erode current shareholder shares, supported this transaction. Bitcoin cost $65,883 per at the time of the transaction; but, it has dropped to $57,000, a 13.5% devaluation in value in less than three weeks.

Bitcoin Jesus: Surpassing MicroStrategy’s Holdings and Powering the Crypto Revolution#BitcoinJesus #CryptoRevolution #BitcoinHoldings #MicroStrategy #CryptoSuccess #CryptocurrencyNews #BitcoinInvestment #BlockchainTechnology #DigitalAssets #CryptoMogul pic.twitter.com/26zkJ7QMpx

— Web3isajoke (@web3isajoke) July 8, 2024

In Saylor’s investment record, this trend of high-priced purchases followed by market declines is not novel. Saylor started his Bitcoin purchasing plan and made nine major purchases where the cost exceeded the current Bitcoin price, therefore causing large paper losses.

MicroStrategy’s overall Bitcoin approach has produced about $4 billion in returns since August 2020 despite these swings. With an average acquisition cost across all transactions of $36,990 per bitcoin, the corporation shows a viable long-term strategy by being much below the current market price.

Beyond the domain of corporate finance, Saylor has deliberately kept his personal funds free from the possible downturns of his company’s debt-heavy investing strategy. Saylor has personally amassed a wealth estimated to be worth $4 billion by selling off significant volumes of MicroStrategy stock and using his holdings in various ways. Forbes Despite the possible hazards connected to the investment plan of his company, this smart negotiating puts him among the world elite in terms of wealth.

Regarding pay, Saylor has set himself to profit independent of the state of the market. His strategy consists of making significant monthly payments, mostly from exercising options, which increases his personal wealth apart from the performance of MicroStrategy.

The First Big Move

In August 2020, Saylor led MicroStrategy to purchase $250 million worth of Bitcoin.

This marked the beginning of the company’s aggressive investment strategy.

This move was a bold statement in the corporate world. pic.twitter.com/hcrTNji1Sh

— Samuel Grisanzio (@samuelgrisanzio) July 8, 2024

Looking ahead, MicroStrategy under Saylor’s direction seems to follow the erratic fluctuations of the bitcoin market. Although Saylor seems ready to keep embracing, the inherent volatility of Bitcoin’s value presents both a risk and an opportunity even if his aggressive strategy has paid well historically.

Key Points:

i. Recent Financial Setback: Michael Saylor, CEO of MicroStrategy, experienced a $105 million loss from his latest Bitcoin investment after purchasing the cryptocurrency at a significantly higher price than its current value.

ii. Aggressive Investment Strategy: Saylor has consistently pursued a high-risk strategy by acquiring Bitcoin through convertible debt, leading to several purchases at prices higher than the cryptocurrency’s current market value.

iii. Profit Despite Fluctuations: Despite periodic losses, MicroStrategy’s overall Bitcoin investment strategy has accrued approximately $4 billion in gains since August 2020, demonstrating the profitability of Saylor’s long-term investment approach.

iv. Personal Financial Safeguards: Saylor has strategically insulated his personal finances from the company’s risky investments by liquidating substantial stock holdings, maintaining a personal net worth that Forbes estimates to exceed $4 billion.

v. Compensation and Corporate Outlook: Saylor benefits from considerable compensation through stock options, maintaining financial stability regardless of MicroStrategy’s market performance, as he continues to embrace the volatility of the cryptocurrency market.

Al Santana – Reprinted with permission of Whatfinger News