Nvidia’s prospects for profits due to the AI boom remain strong, driven primarily by the high demand for its graphics processing units (GPUs) that are essential for AI workloads. In 2024, Nvidia’s revenue is expected to double compared to previous years, largely due to the surging demand for AI chips. This demand has been broad-based across various industries, fueling significant growth in Nvidia’s data center platform. For instance, Nvidia reported a record $26 billion in revenue in a recent quarter, marking a massive increase compared to previous years Business Insider and EconoTimes

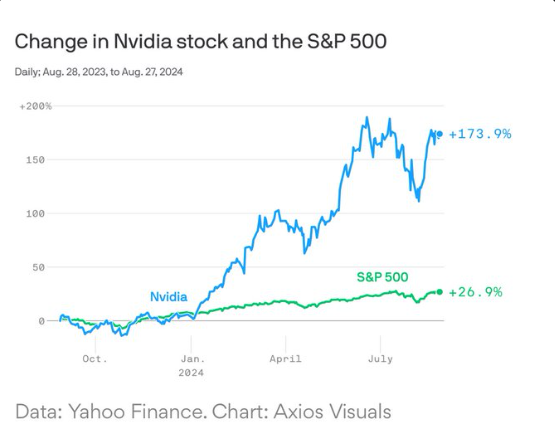

For Nvidia investors, the past two years have been a thrilling ride, but recent months have felt more like a roller coaster. Benefiting significantly from the surge in artificial intelligence (AI) demand, Nvidia’s market capitalization grew about ninefold since late 2022. However, after hitting a record high in June and briefly becoming the world’s most valuable public company, Nvidia’s stock price dropped nearly 30% over seven weeks, erasing around $800 billion in market value. Now, the stock is rallying again, coming within 6% of its all-time high.

All three major indexes rose Tuesday ahead of an earnings report from the most important stock in town, NVIDIA.

Sign up for daily updates: https://t.co/I5OjB8FbXz pic.twitter.com/wzyAeL4iUV

— MoneyLion (@MoneyLion) August 28, 2024

As Nvidia prepares to release its quarterly earnings report on Wednesday, Wall Street is keenly watching the stock’s volatility. Investors are particularly concerned about any signs that demand for AI is slowing or that major cloud customers are reducing spending, which could significantly impact Nvidia’s revenue.

“It’s the most important stock in the world right now,” Eric Jackson of EMJ Capital said in a recent interview. “If they miss expectations, it could have a big impact on the whole market. But I think they might actually exceed expectations.”

Nvidia’s upcoming earnings report follows the financial updates of its tech giant peers, such as Microsoft, Alphabet, Meta, Amazon, and Tesla. These companies have all been heavily investing in Nvidia’s graphics processing units (GPUs) to train AI models and manage large-scale workloads. Nvidia’s revenue has tripled annually in the past three quarters, mainly driven by its data center business. Analysts predict another quarter of substantial growth, although at a slightly reduced rate of 112% year-over-year, amounting to $28.7 billion. However, as comparisons become tougher, growth is expected to slow in the upcoming quarters.

Investors will closely scrutinize Nvidia’s outlook for the October quarter. The company is anticipated to project growth of about 75%, reaching $31.7 billion. Optimistic guidance could indicate ongoing robust investment in AI infrastructure by Nvidia’s major clients. In contrast, a less favorable forecast might suggest that spending on AI infrastructure has peaked.

“Given the sharp increase in hyperscale capital expenditures over the last 18 months, and a strong short-term outlook, there are frequent concerns among investors about the sustainability of current spending levels,” Goldman Sachs analysts noted in a recent report, recommending buying the stock.

“The name of the company is NVIDIA. It’s a cutting-edge high-tech company that’s bigger than Canada’s GDP. It’s so massive that CNBC has a countdown for its earnings and Goldman Sachs says it’s the most important stock on the planet. Everyone and their grandma owns a piece of… pic.twitter.com/YUG7y351UZ

— Genevieve Roch-Decter, CFA (@GRDecter) August 27, 2024

The current optimism surrounding Nvidia’s stock, which has risen nearly 10% in August, stems from recent comments by top customers regarding their continued investment in Nvidia-based infrastructure. The stock closed at $128.30 on Tuesday, up 1.5%.

Last month, the CEOs of Google and Meta expressed strong support for their AI infrastructure investments, arguing that underinvesting poses a greater risk than overspending. Former Google CEO Eric Schmidt recently mentioned that tech companies are in dire need of processors worth billions of dollars to support their operations.

Despite Nvidia’s expanding profit margins, there are still questions about the long-term return on investment for its clients, who are buying expensive devices in bulk. During Nvidia’s earnings call in May, CFO Colette Kress shared data suggesting that cloud providers, which account for more than 40% of Nvidia’s revenue, could generate $5 in revenue for every $1 spent on Nvidia chips over a four-year period. More such metrics are expected in the upcoming earnings report to reassure investors.

Another major concern for Nvidia is the timeline for its next-generation AI chips, known as Blackwell. Recent reports indicate production issues, potentially delaying major shipments until early 2025, although Nvidia has maintained that production will ramp up in the second half of the year. This uncertainty follows CEO Jensen Huang’s announcement in May that significant Blackwell revenue was expected within the current fiscal year.

While Nvidia’s current Hopper chips remain the leading choice for deploying AI applications like ChatGPT, competition is heating up from companies like Advanced Micro Devices, Google, and various startups. This competitive pressure makes it crucial for Nvidia to maintain its technological edge through smooth product upgrades.

Even if Blackwell’s release is delayed, it could result in stronger sales of the existing Hopper chips, especially the newer H200 model. “The shift in timing doesn’t matter much, as both supply and customer demand have quickly moved to the H200,” noted Morgan Stanley analysts in a recent report.

From @axios: “Nvidia’s earnings report this afternoon is one of the most important moments for Wall Street in years, Wedbush Securities analyst and tech bull Dan Ives wrote in a research note.”#markets #Nvidia @DivesTech @nvidia #investing #investors #tech pic.twitter.com/XCgVuEgieb

— Mohamed A. El-Erian (@elerianm) August 28, 2024

Many of Nvidia’s top customers are eagerly awaiting the advanced processing power of the Blackwell chips to train next-generation AI models. However, they are willing to work with the current options available. “We expect Nvidia to prioritize ramping up its Hopper H200s in the second half of the year,” HSBC analyst Frank Lee wrote in a recent note, reiterating his buy rating on the stock.

More…

- However, investor sentiment is mixed due to the high expectations placed on Nvidia. While the company’s stock has surged over 150% this year, some investors are cautious about whether the current demand for AI infrastructure, particularly Nvidia’s GPUs, will lead to sustained profitability. Concerns have been raised about potential production delays for Nvidia’s next-generation AI processors, which could impact their growth trajectory. Moreover, geopolitical factors, such as potential export restrictions to China, could affect long-term profitability Business Insider and EconoTimes and Enterprise Technology News and Analysis

- Despite these concerns, many analysts and investors remain bullish on Nvidia. As Daniel Morgan, a senior portfolio manager at Synovus Trust, stated, “They’re not only a benchmark for chips, but they’re also a benchmark for A.I. as a whole.” This sentiment reflects the view that Nvidia is well-positioned to continue benefiting from the AI boom, assuming it can navigate potential challenges such as production delays and geopolitical tensions EconoTimes

Major Points:

- Nvidia’s stock has experienced significant ups and downs, rising ninefold since late 2022 but then dropping nearly 30% before rebounding close to its all-time high.

- Nvidia has been a major beneficiary of the AI boom, with its revenue tripling annually in the past three quarters, primarily due to its data center business.

- Investors are closely watching Nvidia’s upcoming earnings report for signs of sustained growth or potential slowdown in AI demand, which could impact the stock’s performance.

- Nvidia is facing possible production delays for its next-generation AI chips, Blackwell, potentially affecting future revenue while increasing sales of the current Hopper chips.

- Major tech companies like Google and Meta continue to invest heavily in Nvidia’s technology, reflecting ongoing demand for AI infrastructure despite concerns over long-term returns.

Lap Fu Ip – Reprinted with permission of Whatfinger News