Apple reported impressive fiscal third-quarter earnings on Thursday, surpassing Wall Street’s projections with a 5% increase in overall revenue. Despite the strong performance, shares remained stable in after-hours trading.

Apple $AAPL reported fiscal third-quarter earnings on Thursday that beat Wall Street expectations, with overall revenue rising 5%. Apple shares fell over 1% in extended trading. pic.twitter.com/3A3ICS7I9Q

— CommSec (@CommSec) August 1, 2024

Quarterly Performance Highlights:

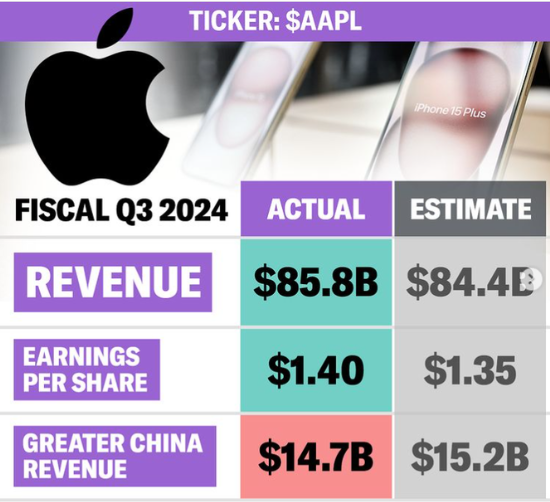

- Earnings Per Share (EPS): Apple achieved an EPS of $1.40, exceeding the anticipated $1.35.

- Revenue: The company’s revenue hit $85.78 billion, surpassing the estimate of $84.53 billion.

- Product-Specific Revenue:

- iPhone: $39.30 billion, above the $38.81 billion estimate, though it saw a slight 1% decline year-over-year.

- Mac: $7.01 billion, just short of the $7.02 billion estimate.

- iPad: $7.16 billion, exceeding the $6.61 billion estimate, showing notable growth.

- Wearables, Home, and Accessories: $8.10 billion, higher than the $7.79 billion forecast, despite a 2% decline in sales.

- Services: $24.21 billion, aligning with the $24.01 billion estimate, reflecting steady growth.

Outlook and Expectations:

- Revenue Growth: Apple expects to maintain similar revenue growth in the current quarter. Operating expenses are projected to be between $14.2 billion and $14.4 billion, with a gross margin forecasted between 45.5% and 46.5%.

- Services Growth: The Services sector is expected to grow at around the same 14% rate as the previous three quarters.

Apple sales rise 5%, topping estimates as iPad and Services revenues jump$AAPL EPS: $1.40 vs. $1.35 estimated

Revenue: $85.78 billion vs. $84.53 billion estimated: CNBC pic.twitter.com/h63Ca460Jm

— Steve Burns (@SJosephBurns) August 1, 2024

Segment Performance:

- iPhone: Remains a key revenue driver, contributing approximately 46% of total sales, though experiencing a small year-over-year decline.

- iPad: Saw significant growth with a 24% increase in sales to $7.16 billion, driven by new model releases.

- Mac: Revenue grew by 2% to $7 billion.

- Wearables, Home, and Accessories: Sales in this category fell by 2% to $8.10 billion.

- Services: Continued to perform well, with a 14% increase in sales, driven by subscriptions and other services.

Regional and Strategic Insights:

- Greater China: Sales decreased by 6% to $14.72 billion amid heightened competition from local rivals like Huawei.

- Active Devices and Subscriptions: Apple reported a record number of active devices and reached 1 billion paid subscriptions, emphasizing its expanding ecosystem.

- AI Investments: CEO Tim Cook highlighted increased spending on AI and data centers, including redeploying resources to support upcoming projects.

Apple reported fiscal third-quarter earnings on Thursday that beat Wall Street expectations, with overall revenue rising 5% $AAPL 🍎

+1% AH pic.twitter.com/6WzgIVEre7

— HerrKamrer (@HerrKamrer) August 1, 2024

Shareholder Returns:

- Dividends and Buybacks: Apple allocated $32 billion to dividends and share repurchases this quarter, demonstrating its commitment to returning value to shareholders.

Apple’s fiscal Q3 report reflects a strong financial performance and strategic investments, positioning the company well for continued growth despite competitive pressures.

Major Points:

- Apple reported a fiscal third-quarter EPS of $1.40 and revenue of $85.78 billion, both surpassing Wall Street’s estimates.

- iPhone revenue was $39.30 billion, above estimates but down slightly year-over-year. iPad saw significant growth with $7.16 billion in sales, exceeding expectations.

- The Services division brought in $24.21 billion, in line with forecasts, showing a 14% increase. Wearables, Home, and Accessories revenue was $8.10 billion, higher than expected despite a 2% decline in sales.

- Apple expects similar revenue growth for the current quarter and plans to continue investing in AI and data centers. Operating expenses are projected to be between $14.2 billion and $14.4 billion.

- Sales in Greater China fell by 6% to $14.72 billion due to increased competition from local tech companies.

Charles William III – Reprinted with permission of Whatfinger News