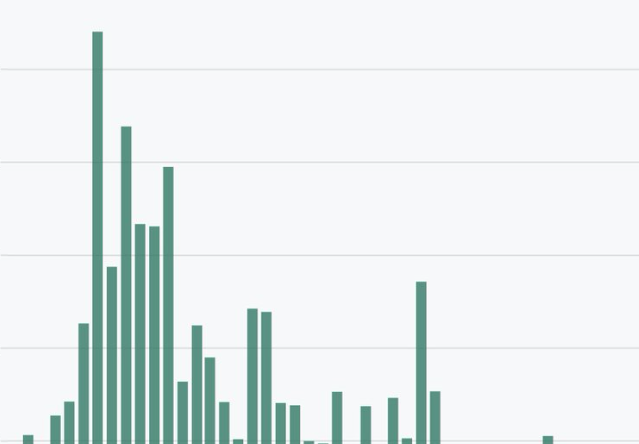

The most recent jobs report reveals a mixed but important trend in the U.S. economy. The country added 142,000 new jobs last month, and the unemployment rate dipped slightly to 4.2 percent. While this improvement is better than July’s numbers, revisions show a job market cooling significantly compared to last winter. This cooling is being closely monitored as the Federal Reserve prepares to adjust interest rates later this month.

📈 The #JobsReport is out. U.S. employers added 142K new jobs in August, a solid number but below expectations—another signal of a continued slowdown in the labor market. With the job market cooling off, it is expected to push the Federal Reserve into lowering interest rates. pic.twitter.com/cNTPquABTa

— Urban League Jobs Network (@ULJobsNetwork) September 7, 2024

Austan Goolsbee, president of the Federal Reserve Bank of Chicago, shared his thoughts on the report. He acknowledged that while the job market is slowing down, it had previously been running too hot. The challenge, he explained, is finding a balance where the market stabilizes at a full-employment level. However, with back-to-back months of lower-than-expected job growth and downward revisions to previous months, concerns about the economy are mounting.

The Federal Reserve is now facing a critical decision on how aggressive to be with interest rate cuts at their upcoming meeting. Goolsbee emphasized that the high interest rates, set more than a year ago, were designed to combat inflation, which has since halved. He believes the economy is now in a different place, where multiple rate cuts over the coming meetings may be appropriate. “This isn’t what overheating looks like. If anything, it’s overcooling,” Goolsbee remarked, suggesting the Fed should adjust accordingly.

Despite some economists arguing that rate cuts need to be larger and sooner, Goolsbee cautioned that timing is everything for central banks. The goal is to stay ahead of the curve without overcorrecting. While inflation has dropped, the slower job growth and rising unemployment rate create concerns that the economy could slip further if the labor market doesn’t stabilize. If job creation slows further, fears of a possible recession may become more pronounced.

New data from ADP released Thursday showed the private sector added its fewest jobs in a month since January 2021, signaling a cooling labor market. pic.twitter.com/Ea9mnZokNl

— Markets Today (@marketsday) September 7, 2024

In addition to labor market concerns, Goolsbee also touched on the commercial real estate sector, particularly the struggling office space market. Many office buildings are experiencing higher vacancy rates post-pandemic, raising fears about significant losses for banks and investors. However, Goolsbee noted that the situation, while troubled, hasn’t led to the anticipated credit crunch in the banking sector. He suggested that any future rate cuts could make it easier for real estate owners to refinance and stabilize the situation.

As the Federal Reserve prepares for its next move, all eyes are on whether the labor market will cool further or stabilize. The coming months will be pivotal in determining the direction of the U.S. economy.

Key Points:

i. The U.S. added 142,000 new jobs last month, with the unemployment rate dipping slightly to 4.2 percent.

ii. The job market is cooling compared to the past winter, raising concerns about the overall state of the economy.

iii. Federal Reserve President Austan Goolsbee believes multiple interest rate cuts may be needed to prevent the economy from overcooling.

iv. Some economists argue for larger rate cuts, but the Fed is focused on careful timing to avoid overcorrecting.

v. The commercial real estate sector is facing challenges, particularly with high vacancy rates in office buildings, though a credit crunch has been largely avoided.

Deen Jackson – Reprinted with permission of Whatfinger News