The Fed is up to their old games again. And the dollar will suffer, which means you will suffer by way of prices for all goods

“It seems there’s enough tailwind that the Fed doesn’t have to engage in great rate cuts,” says Canyon Partners Co-CEO Joshua Friedman. “There’s a pretty big disparity between the market’s expectations and what economists expect right now. I lean on the side of the economists.” see clip below

“It seems there’s enough tailwind that the Fed doesn’t have to engage in great rate cuts,” says Canyon Partners Co-CEO Joshua Friedman. “There’s a pretty big disparity between the market’s expectations and what economists expect right now. I lean on the side of the economists.” pic.twitter.com/DWEHAaGtqA

— Squawk Box (@SquawkCNBC) January 17, 2024

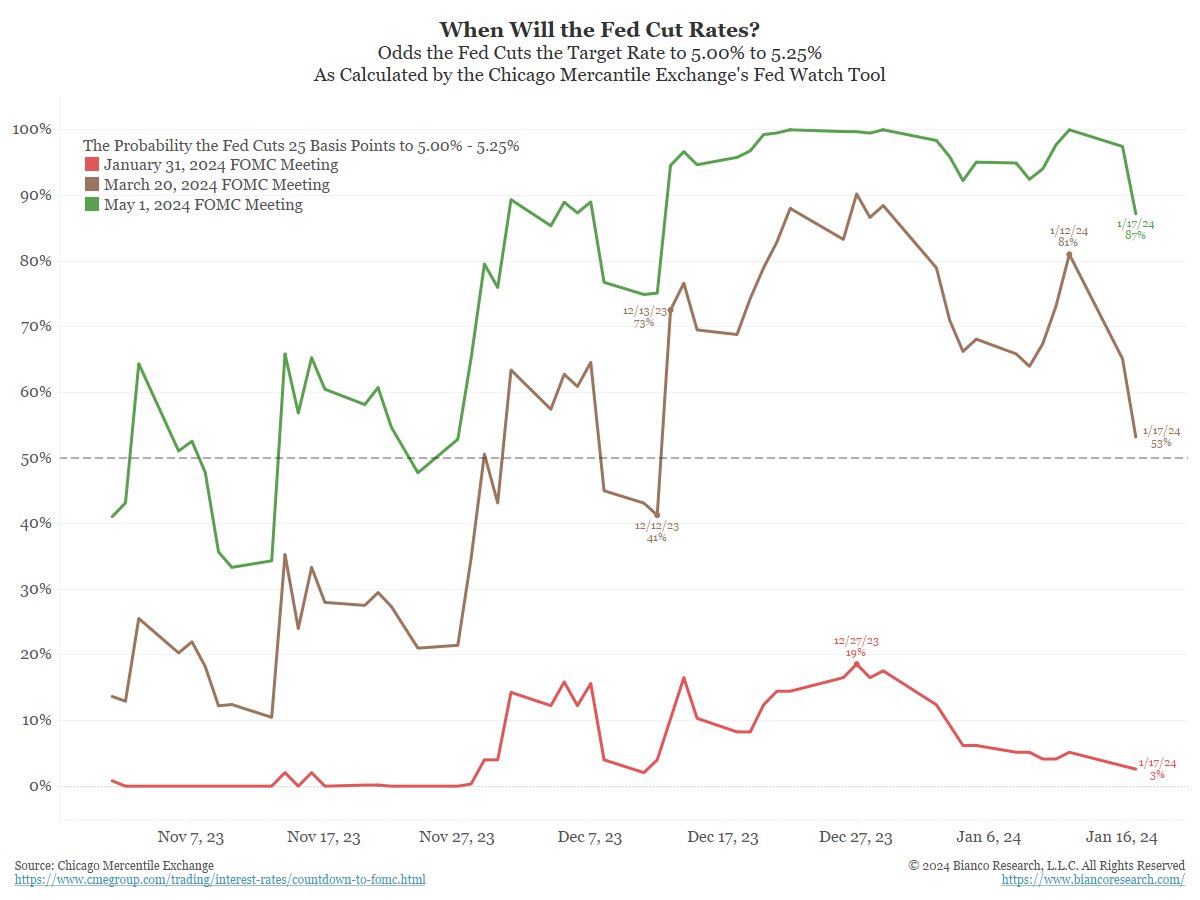

Screaming Red Bloomberg Headline *FED SWAPS TRIM ODDS OF MARCH INTEREST-RATE CUT TO ABOUT 50% No cut in January (red) is priced, and the air is coming out of a March cut (brown) pricing. Still 87% for May 1 (green), but that is three payrolls and three CPI reports away.

On December 13, the financial landscape experienced a significant shock as the Federal Reserve executed an unexpected dovish pivot, putting an end to its previous stance on rate hikes. This abrupt change contradicted Chairman Jerome Powell’s statement just two weeks earlier, where he deemed it “premature” to speculate on rate cuts.

Gold is going to bust up. “It’s All Over Now”: Powell’s WSJ Mouthpiece, JPMorgan Confirm Imminent End Of QT – Cussing Conservative

Notably, those who followed alternative financial analysis, such as War Room, were less surprised by the Fed’s sudden shift. A week before the Federal Open Market Committee (FOMC) meeting in December, many analysts predicted the change. The rationale behind this foresight was outlined in their article, “The Canary Just Died: Sudden Spike In SOFR Hints At Mounting Reserve Shortage, Early Restart Of QE.” The key argument presented was the Federal Reserve’s lack of choice in pursuing a dovish stance due to dangerously low liquidity levels in systemic and interbank plumbing.

There it is folks: Markets are now expecting a rate cut at EVERY MEETING in 2024 beginning in March. That’s right. 7 STRAIGHT interest rate cuts this year to bring the Fed Funds rate down to 3.50% to 3.75% in December. Meanwhile, the Fed’s latest guidance showed 3 cuts in 2024 and officials are questioning if March is too soon to start. Buckle up because it’s going to be a wild year.

The spike in the Secured Overnight Financing Rate (SOFR), reaching unprecedented levels and resembling patterns seen during the repo market crisis in March 2020. Despite lower repo volumes and limited excess cash, the spike indicated growing reserve scarcity, potentially leading to a reassessment of banking system reserves and an early end to Quantitative Tightening (QT). The looming threat of another round of Quantitative Easing (QE) became apparent if the funding shortage persisted.

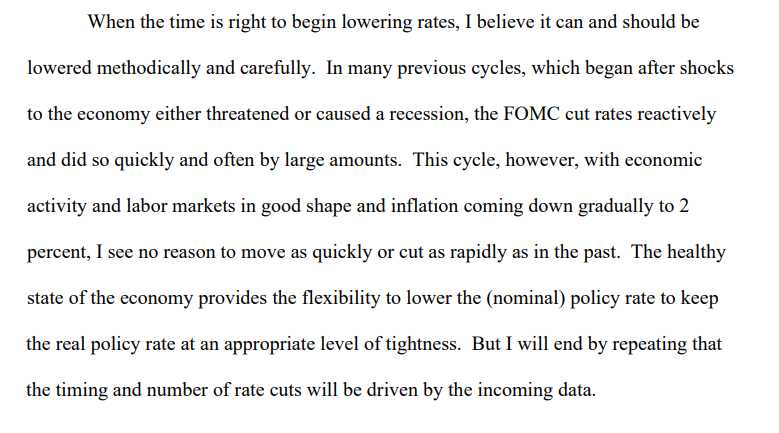

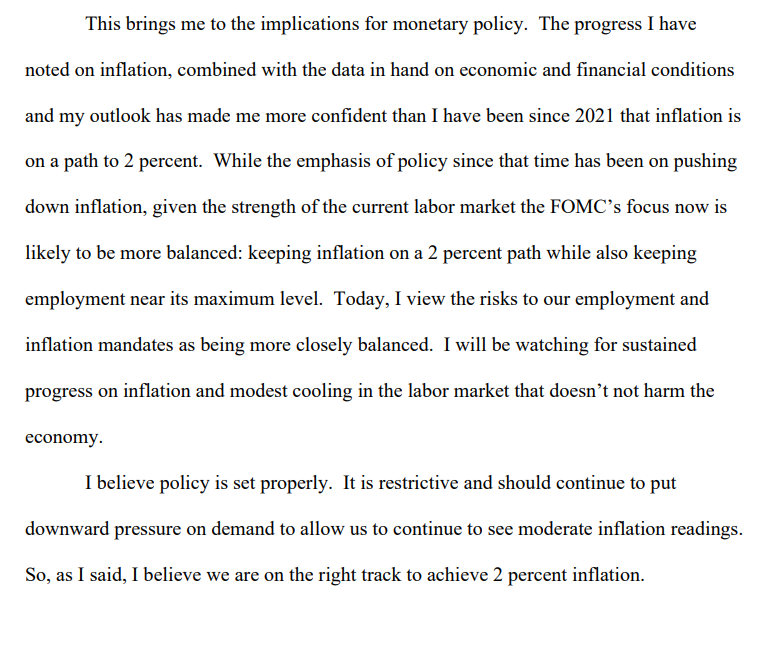

Fed governor Chris Waller: Rate cuts are coming into view but the process should be “carefully calibrated and not rushed.” As long as growth is fine, “I see no reason to move as quickly or cut as rapidly” as the Fed has in past cutting cycles’ – said Nick Timiraos (see below)

Why is there socialism for rich people in America? The Federal Reserve.

ZH: "Powell's WSJ Mouthpiece And JPMorgan Confirm Imminent End Of QT" because QE is just socialism for the rich.

It's shameful and disgusting with pervasive high inflation going on 3 years now.

MLK got it. pic.twitter.com/NqCMMWbZhS

— Fix The Fed (@FixTheFed) January 16, 2024

Dallas Fed President Lorie Logan publicly acknowledged the end of QT due to an unforeseen slide in systemic liquidity, mainly attributed to the rapid drain in the reverse repo facility. ‘“It’s unlikely that there will be no rate cuts this year because inflation does seem to be on a downward trend, and it’s possible that things could weaken further,” says Former Fed Chairman Roger Ferguson – see clip below

“It’s unlikely that there will be no rate cuts this year because inflation does seem to be on a downward trend, and it’s possible that things could weaken further,” says Former Fed Chairman Roger Ferguson to @FrankCNBC pic.twitter.com/F7M7SZcWyc

— Worldwide Exchange (@CNBCWEX) January 17, 2024

Recent developments suggest that another round of QE might be imminent. Media reports, including those from Nick Timiraos, a reputed source with insights into the Fed’s thinking, confirm that deliberations on slowing down QT are underway.

The time to prime the Fed printer has come again : Powell's WSJ Mouthpiece And JPMorgan Confirm Imminent End Of QT. we fully expect the next QE to be launched in the near future, sending the dollar into its next, and possibly final, reserve currency death spiral as printer goes… pic.twitter.com/l1zQjCNEqt

— Marcus Cottus (@cottusmarcus) January 16, 2024

The driving force behind the QT runoff appears to be the clogging of financial plumbing, as evident from the decline in the overnight reverse repurchase facility. The Fed’s fear of repeating the repo market turmoil in 2019 and the basis trades eruption in March 2020 adds urgency to the need for contingency planning. The accelerated rate of decline in the reverse repo facility’s balances is raising concerns, prompting the Fed to consider slowing down the QT process.

Market signals now play a more significant role in the Fed’s decision-making, indicating a departure from previous miscalculations. This shift is crucial in understanding the central bank’s approach to maintaining ample reserves in the system, especially in light of unexpected events like the December SOFR spike.

"Good morning! 🌞 Exciting news from major banks suggesting the end of QT in the U.S. is near, sparking optimism in the market. JPMorgan hints at discussions in the January meeting that could unveil the timeline. Stay tuned for updates! 📈 #MarketWatch #Finance #MrStockable" pic.twitter.com/wcsCRcABFV

— MrStockable (@MrStockable) January 15, 2024

In response to the potential risks associated with continuing the current pace of QT, officials are contemplating a slowdown later in the year. This strategic move aims to reduce the likelihood of a premature stop, which could lead to a market crash – a scenario deemed unacceptable, particularly in an election year.

JPMorgan’s forecast aligns with this evolving narrative, predicting a formalized plan for the wind-down of QT to be agreed upon in March, with implementation beginning in April. This timeline involves reducing the monthly cap on the runoff of Treasury securities from $60 billion to $30 billion.

For an in-depth look at the Federal Reserve, raising or lowering rates, and the U.S. economy overall – see the following vid. It is detailed and long though, so you might want to listening while surfing other links

How Kevin muir is seeing things: – Those expecting a recession will continue to be wrong as supersized government deficits fuel demand – Inflation will surprise to the upside over next decade – Market is likely pricing in too many Fed cuts this year – Rate volatility is cheap… perhaps too cheap – Kevin is very bullish on inflation breakevens (market pricing of forward inflation expectations, obtained by subtracting real interest rates from nominal rates) because the fiscal deficit “genie is out of the bottle” – Inverted yield curve no longer works as a recession indicator – perhaps this is so because the Fed changed the nature of money during the Great Financial Crisis (i.e. the Fed transitioned from a Corridor System to a Floor System) – Kevin continues to like Japanese equities – Buy-write ETFs are a “terrible product” and have gotten way out of line Huge thank you to @public for sponsoring this interview! As usual, this interview can be viewed on @ForwardGuidance podcast apps (Spotify, Apple podcast, etc.) as well as on YouTube on the Macro” channel. Spotify has video now… see below

How @kevinmuir is seeing things:

– Those expecting a recession will continue to be wrong as supersized government deficits fuel demand

– Inflation will surprise to the upside over next decade

– Market is likely pricing in too many Fed cuts this year

– Rate volatility is… pic.twitter.com/1RAKOHxlEc

— Jack Farley (@JackFarley96) January 16, 2024

- Be prepared for anything, including lockdowns with your own Emergency Med kit – see Wellness Emergency Kit (includes Ivermectin and other essential drugs – get approved over the phone – Dr. McCullough’s company!) 🛑

- Get the Spike Control formula to help you clean your blood out of spike proteins from the vaccine. Proven to clean blood and save lives. 👍 – Whatfinger Sponsor

More on topic…

Predicting we’ll get three or four rate cuts and a soft landing this year, JPMorganAM Portfolio Manager Phil Camporeale says he currently has his largest overweight allocation to equity since the Fed first started tightening policy in 2022.

Predicting we’ll get three or four rate cuts and a soft landing this year, @JPMorganAM Portfolio Manager Phil Camporeale says he currently has his largest overweight allocation to equity since the Fed first started tightening policy in 2022. pic.twitter.com/vlgKkwju2D

— Money Movers (@moneymoverscnbc) January 17, 2024

Major Points Discussed:

- On December 13, the Federal Reserve surprised the financial world with an unexpected dovish pivot, contradicting Chairman Powell’s earlier stance on rate cuts.

- Zero Hedge accurately predicted the dovish turn a week before the Federal Open Market Committee (FOMC) meeting, citing dangerously low liquidity levels and a spike in the Secured Overnight Financing Rate (SOFR).

- Dallas Fed President Lorie Logan confirmed the end of Quantitative Tightening (QT) due to an unforeseen slide in systemic liquidity, specifically the rapid drain in the reverse repo facility.

- Recent reports suggest that the Fed is considering slowing down QT, with concerns about potential disruptions in critical corners of the financial markets, particularly an obscure but crucial segment.

- The Fed is now relying more on market signals to identify the right level of reserves. Contingency planning is underway to address the accelerated decline in the overnight reverse repurchase facility, reflecting a shift from past miscalculations.

Comments – Threads – Links

- Ten-year Treasury yields jumped on comments from Fed‘s Waller. As far as I can tell, there was nothing new in his comments, but he seemed to discourage the prospect of a March rate cut. We are sticking with our view that May is likely with Mar about tapering QT. Kathy Jones

- Lots of Fed Clowns talking today.. they’re tapering expectations on rate cuts, largely because inflation is stuck, and will remain stuck. – Frog Capital

- What QT? Am I missing they’ve given $1T in QE to banks from March through March? We haven’t seen QT and hence the increase in CPI! – Scared_Cats

- I was called a lot of bad names on here for telling all of you that inflation wasn’t being caused by money supply & raising rates was foolish and dangerous. Well, here we are. After record rate hikes, inflation is still here & the Fed is poised to now cut. Interest rate bros? JJ

- After an aggressive tightening cycle, 152 central banks around the world expect to cut rates in 2024, including the Fed Based on history, rate cuts are NOT bullish for the US stock market – Game Of Trades

-

Not sure QT matters because the money supply impulse has filtered through the economy and I’m unsure there’s a point in trying to bring down asset prices. At this point, what matters is deficit spending and bank lending. – L Jones

-

Someone knows something, this is bearish for stock market – Kitten

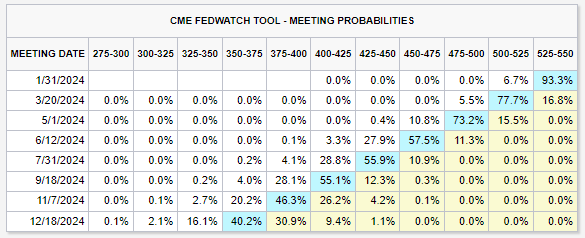

- CME Fed Watch Tool – Meeting Probabilities for march 2024 still predicts FED cat rates. Nothing new to see – crypto data

-

Well, that should provide the economy with a “dead cat bounce.” – Pep

News Junkies Delight…. One visit and you are hooked…. Come over to Whatfinger’s main page. All news and more news than any other site on the net.